Micro Finance Program started in

Goal

Geographical Coverage

Micro Finance Program (MFP)

About the Program:

Starting year of the Microfinance program is in 1978. Microfinance program aims to promote and ensure human right of the beneficiaries; beside this HEED Microfinance desires to eradicate poverty, create new employment, improve living standard, empower women, create saver’s attitude, raise awareness, provide financial assistance, create entrepreneur, provide training etc.

Relationship of Microfinance with SDG:

SDG-01: End Poverty

Microfinance: Access to financial service such as, savings, financial support, capacity building, new employment creation, are the formulae of overcoming the poverty.

SDG-02: Zero Hunger

Microfinance: Through Integrated Agriculture (Agriculture, Fisheries & Livestock Program), KGF program build a sustainable and strong agricultural environment. It also strengthens farmer’s capacity which is the way to reduce hunger.

SDG-03: Good Health and Well being

Microfinance: Finance service increases the capacity for spending money for ensuring good health and for the well-being of masses. Also through Enrich and PPEPP Program we provide medical assistance to the beneficiaries.

SDG-08: Decent Work and Economic Growth

Microfinance: Microenterprise loan boasts entrepreneurship and employment in the country; this is the key of economic growth.

SDG-10: Reduce Inequality

Microfinance: Gaining opportunity to work across the gender line; also access to digital financing increases income of the poor households. This is the way of reducing inequality.

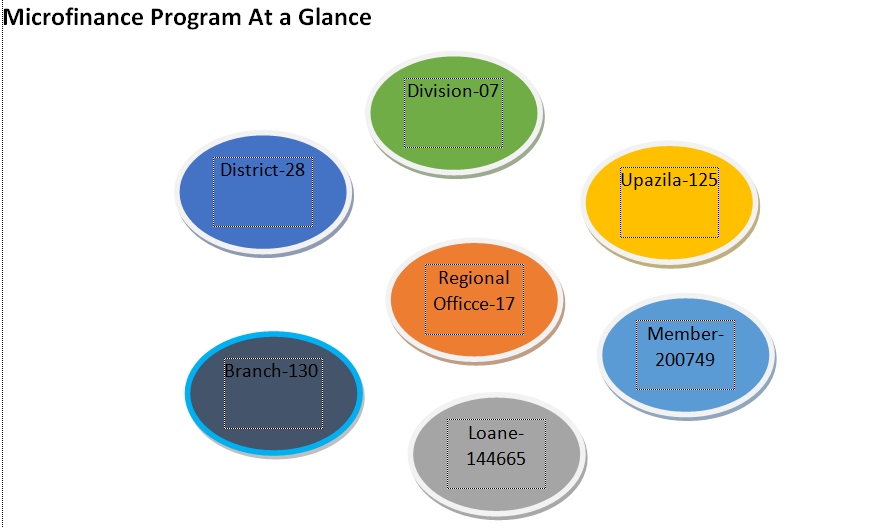

At a Glance:

Components of the Microfinance Program:

HEED Savings Product:

- General Savings

- HEED Savings Scheme (HSS- Monthly Savings)

- HEED Annual Savings Scheme (Long Term)

- Special Savings (In Enrich Program-for disabled person)

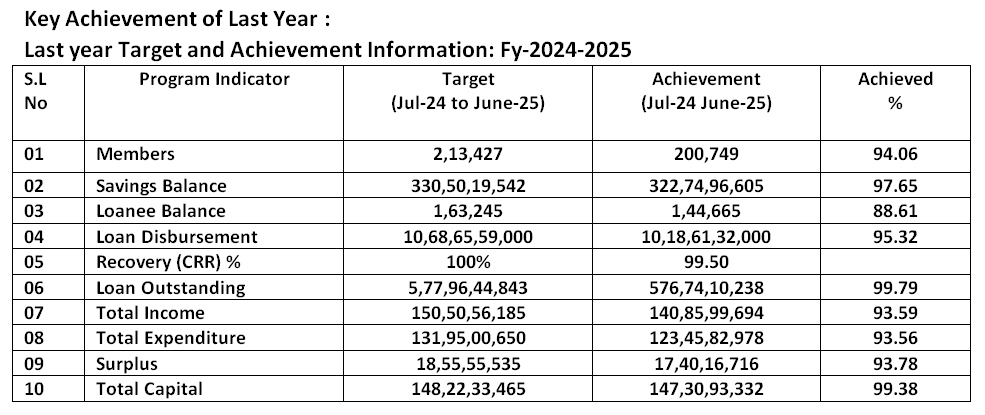

Key Achievement of Last Year:

Microfinance Program at a Glance:

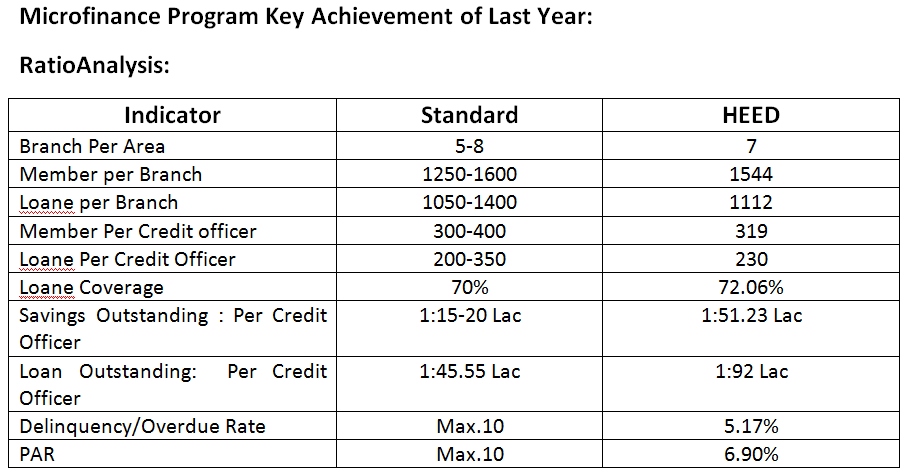

Ratio Analysis:

Total Savings Outstanding:

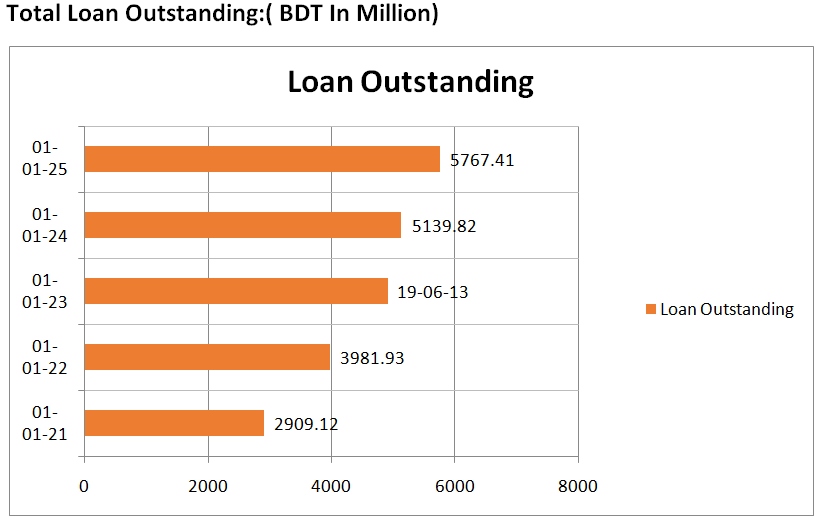

Total Loan Outstanding:

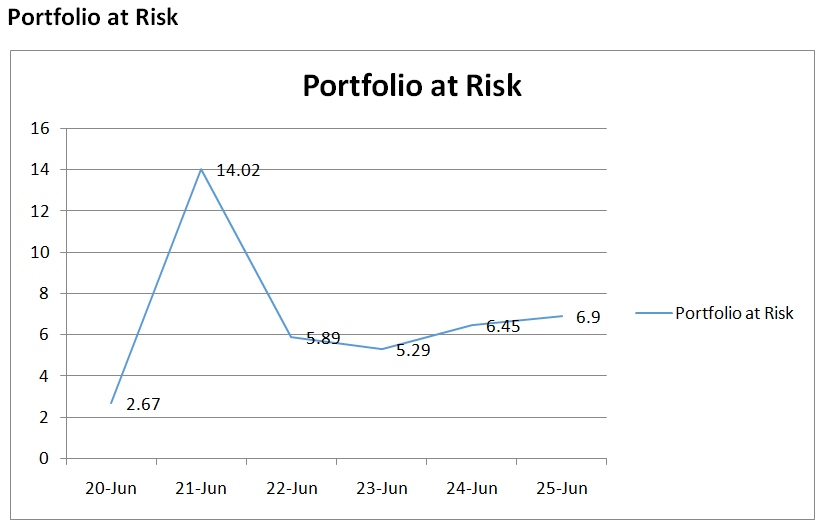

Portfolio at Risk (PKSF Standard):

Lesson Learned by Implementing this Project:

• Importance of the monitoring and communication in the program implementation.

• Importance of the prudent leadership ability

• Managing the situation of unexpected natural disaster.

Case Study 01: A story how Kalpona Begum became an Entrepreneur

Kalpana Begum is the 2nd child out of the 05 children of her parents. Her father name is Md. AbulHasem Miah. They lived in Badda Area under Dhaka District. Due to their poor economical conditions Kalpanhad taken a job in one of the garments factory and support her family members.In 2003, her father arranged Kalpana Begum’s marriage and married her off. After her marriage she quit her job and went to her husband house. Her husband financial condition was also not good. Also she wants to be an entrepreneur.

So in 2004 Kalpana bought a swing machine and collect order from various shops and start sewing. With the money from her sewing business Kalpana Begum start Cloth Business in small scale in 2008. In this way, she continued her business despite many difficulties.

In 2020 Kalpona Begum joins in Badda Branch operated women’s group under HEED Bangladesh.

She had taken loan from HEED MFP program for buying 02 cows with calves. That time she sells 30 liters of milk. She successfully runs the cow farm. Now she has 8 cows and 6 calves and everyday she sells 80 to 90 liters of milk. She in now became solvent. She has hired 02 staffs in her farm to assist her completing all the work.

Kalpona Begum became an entrepreneur with her hard work and dedication. She is the role model of her surroundings. Now she advised other people how to become an entrepreneur.

Kalpona says that it is possible only because of HEED Bangladesh MFPs support and cooperation. She praises HEED for being with her side and wants to continue her journey with HEED Bangladesh.

Case Study 02: Successful Micro Entrepreneur Omar Faruq

Youth is the strength, development of the country depends on the youth. One of the successful youths’ name is Omar Faruq. He took up a different enterprise. Average people don’t take up this kind of enterprise. Omar Faruq lives in the Shanerhat area of Rangpur District. He was unemployed after passing the SSC examination. Suddenly he thought that his locality is enriched of cattle rearing. So he decided to do something new and he bought a milk churning machine with some of his own money. Everything was running smoothly. But in 2020 Corona Pandemic destroyed everything. It collapsed everything. His business was almost closed. He didn’t know what to do.

At that time Omar Faruq precipitously meet with the Branch Manager of HEED Bangladesh. Through Branch Manager he came to know the various loan products of HEED Bangladesh. He also felt that loan repayment system was very easy and repayment rate was low. So Omar Faruq decided to join the Agrosor group of HEED Bangladesh under the Shothibari Branch named ‘Satota Agrosor Group’. Omar Faruq got 200,000/- taka loan from Agrosor MDP loan product. After getting the loan he resumed his milk churning project. Now he has 2 milk churning machines. He can keep 5000-liter milk per machine. He collects the milk from his nearest farm and local people. Mr. Omar Faruq supply these milk to Arong, Milk vita, Pran etc. Every day he buys and sells 7000-8000 liter of milk. He has one shop to sell the milk and to look after this procedure he has 2 (two) staff. His monthly income excluding all the expenses stands to 30,000/- taka. Omar Faruq has one child. He gets the taste of success as an entrepreneur by his own wisdom and through his hard work with a little support of HEED Bangladesh.

He is very much thankful to HEED, because, when he lost all his hope due to Corona crisis, at that time HEED supported him to fight back and gain the success.

Case Study 03: Dream comes true of Nasrin Begum

Nasrin Begum is a Group leader of Shuvecchha Women’s Group of HEED Bangladesh under Tongi-01 Branch. She is with HEED for the last 12 years. She faced extreme poverty in her life before involving herself with HEED. HEED gives her the opportunity to get sustainability in her life. Her husband’s name is Md. Rafiqul Islam. He is a businessman. His business product is Electronics goods. He is doing very well in his business. But one day they had nothing. They lived in a house which was made by tin. Nasrin’s husband used to go from door to for doing electrical work.

Nasrin took 20,000/- taka as her 1st loan and they start Electric equipment business. From that time they didn’t need to look back. After that Nasrin took loan many times. Nasrin converted her house from tin to furnished brick build house from the loan money. From that house Nasrin now gets 35,000/- taka per month as rent.

Nasrin and her husband are now well established business persons. Her husband started Furniture business beside his electronic goods business. One day they starved for food but today things are changed, all because of their hard work and with a little support of HEED Bangladesh.

Currently Nasrin’s ongoing loan is 99,000/- taka. She has started her journey from zero, but now her monthly income nears about 50,000/- taka plus. They have 3 children, all of them are studying.

They are thankful that HEED Bangladesh is always with them and continues to support them to increase their living standard.

Case Study 04: Story of Lucky’s Success:

Mongla is a very disaster prone area in Bangladesh. Lucky Akter is from this kind of disaster prone area. Name of her village is Macoredon. It is under Bagerhat Area. Lucky’s husband was a small fisherman. Her earning was not enough to maintain their family member. So they used to live in a very poor condition.

One day Lucky heard about the group named “Papiya Womens’ Group” of HEED Bangladesh under Mongla Branch. At first she took 50,000/- taka loan for Fish Cultivation purpose. For first time she got profit. Seeing the profit she became more interested about the business. Along with fish business she bought a cow for rearing. Se slowly increased her cow rearing farm. Now she has 12 cows in her farm along with 4 calves. Her last loan was 150,000/- taka. She paid off the loan properly. She constructed a house made by brick with her extra income. Nasrin has one daughter, she continues her study. Nasrin dreams that one day her daughter will be a doctor.

All women who saw Nasrin in a negative way, who sneered at her for working outside the home, they now praise her and want to be like her. And Nasrin is thankful to HEED for giving her the opportunity and supporting her to fulfill her dreams.

Case Study 05 : Ekramul is now a Successful Entrepreneur

Md. Ekramul Hoque is a youth of Shanerhat Union under Mithapukur Upazila of Rangpur District. He grew up in the lowest middle income family. From his childhood he faced many difficulties. So he became determined that he must be successful in his life by hook or by crook. That’s why after completing his MA degree firstly he started doing a job in a private organization. He worked there for 3 year. Then he resigned from his job and started a Veterinary Pharmacy at Shanerhat Bazar. In the beginning he had to go through a lot of difficulties. In Corona Pandemic time in 2020, due to capital crisis his earning almost stopped. At that moment he heard about HEED Agrosor group, namely, ‘Sotota Agrosor Group’ under Shothibari Branch. Md. Ekramul Hoque contacted the Branch Manager and discussed all about the rules and regulations of the Group.

Through discussion he found out that from Agrosor Group he would get loan for business purpose. He also came to know that repayment system of the organization was very easy and interest rate also very low. So he decided to join the group. Firstly he took 20,000/- taka Agsosor loan for properly running his business. He bought all the veterinary items for his Veterinary Pharmacy and started over his business. As Shanerhat is suitable for agriculture and for cattle rearing, so he started supplying wholesale medicine for cattle. He has now 1 staff beside him for taking care of the shop. His shop has medicine worth near about 10 lac taka. His monthly income excluding all the expenses is about 40,000/- taka.

He has 1 daughter and 1 son in his family. His hope is that he will educate his children in a proper way. Md. Ekramul Hoque is thankful to HEED for supporting him during the Corona Pandemic. He says that, HEED brings good luck for me, that’s why I became successful in my life.

Different Scholarship in MFP

HEED Bangladesh has endeavored to support the education of its beneficiaries since its starting. For this purpose the organization has been providing educational scholarship to those underprivileged yet brilliant to continue their study. From 2010 organization extended their scholarship program. Now a day’s HEED Bangladesh provide various types of scholarship. Such as-

1) One time Scholarship for those student who obtained GPA -4 to GPA-5 in JSC/SSC/HSC examination:

Beside Bangladesh Government HEED Bangladesh also working towards spreading education. Due to this reason HEED Bangladesh implement various kinds of incentives, such as- scholarship. HEED start one time scholarship program for preventing dropout, beside this the children of the minority/backward community of the society are not deprived from the opportunity of the good education. The organization provides one-time scholarship of Rs.2000/- to JSC passed students, GPA-4 passed students=4000/- and GPA-5 passed students=5000/-. Around 4200 students have been awarded one time scholarship by the Organization in this financial year.

2) Special Scholarship:

Apart from the Microfinance program, HEED Bangladesh also provides scholarships to non-beneficiaries of the organization. HEED Bangladesh has decided to provide scholarships based on merit in view of the applications of underprivileged people from different parts of Bangladesh to continue their children’s education expenses. This financial year HEED awarded 15 students with the special scholarships.